2.5 years ago, while freelancing, I was approached by the founders of Savvy. I developed their first mobile app, came up with the company's name, and created the initial branding. From there, I continued working with them on developing the mobile app over the next year. I then made the decision to join the company full-time, coming on board as Head of Product & UX Design.

Many people seek clarity on the impact of their money but are confused by investment jargon and greenwashing. Savvy simplifies this by offering a clear, jargon-free investment experience. Users can:

-

Create a sustainable investment profile tailored to their preferences.

-

Track the sustainable and financial impact of their investments, e.g., "You've generated renewable energy equivalent to 48 washing machine cycles."

Savvy makes sustainable investing simple and transparent.

-

As Head of Product and UX Design at a fintech start-up, I:

-

Led rapid product iteration and designed innovative investment tools that drove user engagement.

-

Customized solutions for key clients, delivering tailored features and seamless white-label integration.

-

Drove user-centric improvements through regular testing, interviews, A/B testing, and market research.

-

Managed a team consisting of myself and 2 UX Designers, collaborating closely with the CEO, CTO, and dev teams to align on vision and execution.

-

Continuously asking myself and my team 'How are we solving for X pain point and will this change actually positively impact their experience?

-

Performance and Impact

The platform (named Visibly) forecast to generate €3.7m in revenue fees for PostFinance this year.

88% of customers who used the platform stated that it positively impacted their perception of PostFinance and their commitment to sustainability.

Strong positioning as an innovative market leader.

01-Problem Discovery

In October 2023, the founders of Savvy and I embarked on a journey to explore a new opportunity with PostFinance. Our proposition was simple yet powerful: we could deliver a platform that would enable PostFinance to offer its clients a seamless, sustainable investment experience in the digital realm.

Our initial meetings with PostFinance’s leadership team were promising, setting the stage for more in-depth discussions. As we moved forward, we knew it was essential to dig deeper. We needed to understand the market landscape and align our vision with PostFinance’s broader objectives.

Together with the wider PostFinance team, we initiated a comprehensive problem and research phase.

Our mission was twofold:

-

Assess Market Potential: Was there a significant market opportunity for a platform like this? And more importantly, did it resonate with PostFinance’s long-term strategic goals?

-

Gauge Customer Interest: Were PostFinance’s clients truly interested in a platform focused on sustainable investments? And crucially, would they be willing to pay for such a service?

Assessing Market Potential

01-Problem Discovery

PostFinance want to approach and manage sustainability progressively in the strategy period 2025-28. Opportunity to stay ahead of the curve if implemented with speed.

We started out with analyzing the competitive landscape in Switzerland and the intensity of market developments in the realm of sustainable investing.

Amongst other partnerships, the market developments in sustainable investing intensify in Switzerland.

Partnership of Invoya X Neon (Competitor Banks) for Impact Investing.

Market developments

Competitive analysis

Market research

Sustainability in fund investments is key and here to stay.

Last year, sustainable funds received 90% of newly invested money in Swiss Franc (CHF 67bn).

Market share increase of sustainable funds from 6% in 2019 to 22% in 2023.

Sources: Hochschule Luzern (HSLU), IFZ Sustainable Investments Studie 2023, November 2023.

.png)

Gauge Customer interest and pain points

01-Problem Discovery

118 participants were asked to answer 54 questions. They were between 25-40 years old. Participants selected were digitally competent, have invested and are interested in sustainability.

.png)

.png)

.png)

Sustainability is a big factor in investing for our target group: Panel testers ranked sustainability (55%) above risk (49%), social factors (43% ), geography (26%) and sector (30%).

The concept of sustainable investing received an average familiarity score of 4.22 out of 5.

70% of respondents stated that they were 'very interested' in the theme of sustainability.

Some of the results

02-Defining the problem

In order to present our findings succinctly to senior PostFinance stakeholders, we created 2 personas which we felt embodied the target group, we then highlighted the core problems facing our customers and why a solution like Visibly was needed.

At this stage, we were communicating these problems to various internal teams within PostFinance, we found there was more demand from the retail side and that the asset management side had both regulatory and implementation concerns which we would have to tackle before moving forward.

First major challenges arose

.png)

.png)

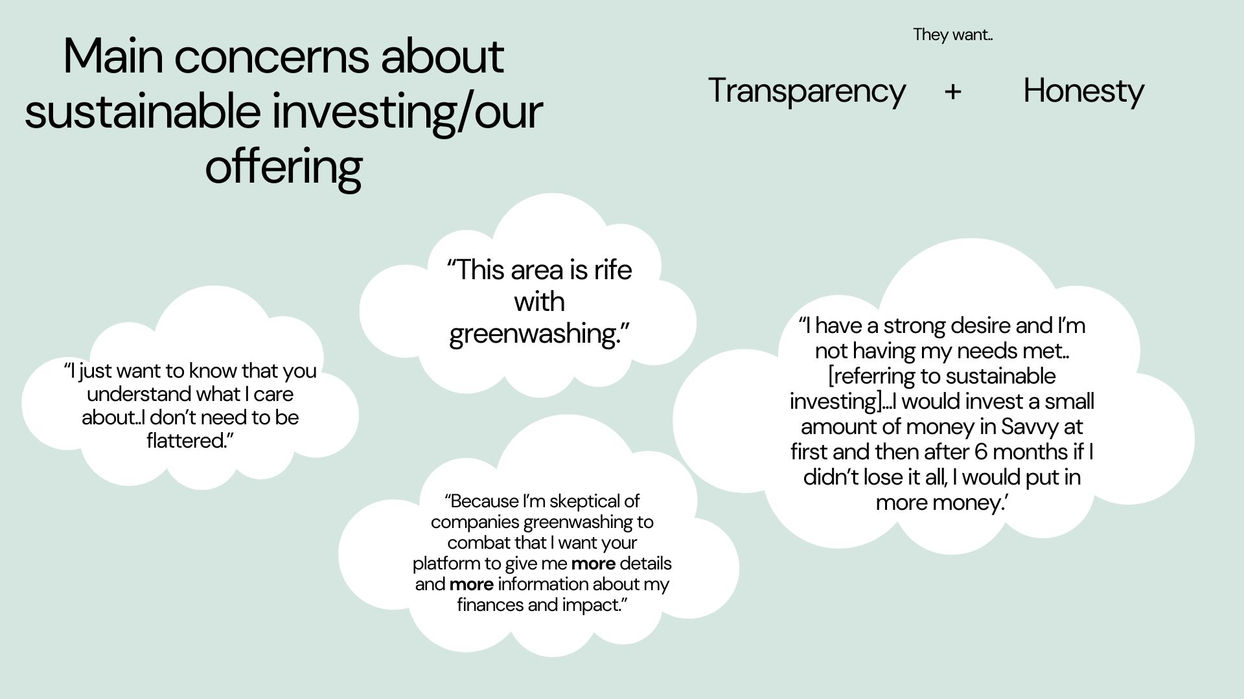

Core pain points identified

.png)

Difficult fund selection

There are around 2,200 sustainability funds on the Swiss market. It is difficult and tedious for customers to choose the best fund for them personally.

Customers are concerned about greenwashing: Only 24% of ESG funds are in the best sustainability category.

Greenwashing

Little know-how

It is difficult for retail investors to interpret fund information.

Customers have to laboriously analyze fact sheets to understand the lasting impact of their investments.

Low-transparency

.png)

.png)

.png)

Problem Statement

"I want a simple, transparent, and trustworthy way to invest in sustainable funds that helps me avoid greenwashing and confidently understand where my money is going and its impact.

.png)

03-Designing.

To bring Visibly to life, several key steps were essential in tailoring Savvy's core product:

1. First off we whitelabelled the platform rebranding it as 'Visibly,' and carefully selected brand colors that resonate with its identity.

2. Next, we handpicked specific impact metrics that would define Visibly's focus, ensuring alignment with our vision.

3. I manually translated the platform to German as we would conduct half of the user testing sessions with German speakers.

3. Collaboration played a crucial role, as our internal development team worked closely with PF's external dev team to synchronize their universe of funds with the platform.

4. Finally, we integrated PF’s fund universe seamlessly into the Savvy platform, creating a cohesive experience that was both impactful and aligned with Visibly’s mission.

Customisation of Savvy's core product for PostFinance.

.png)

Styling

The essence of Savvy's style was preserved, characterized by a clean and simplistic interface, a friendly and approachable tone, and a clear, intuitive user experience.

Colours

Savvy colours (usually purple and bright green) were changed to the light yellow and deep teal green shades shown. PostFinance wanted to keep an element of yellow (as exists in their branding) but wanted to add another colour that represented Visibly. I selected the deep teal green to add an element of professionalism to the platform.

Typography

Outfit was selected as the platform font. Adding to the simplistic and natural feel of the platform.

Accessibility

Colour contrast-passes all WCAG checks bar WCAG AAA.

Keyboard Navigation-Pass. All forms and buttons were accessible via keyboard navigation.

Accessible Fonts-Pass.

Iconography

The PostFinance team initially resisted using the icons I had created for Savvy, feeling they were too "game-like," and preferred simple outlined icons. However, I advocated for retaining our icons, arguing that they added a unique, engaging touch, particularly in the questionnaire section where we anticipated higher drop-off rates. The team agreed and we received positive feedback later directly from users.

Investment platforms on the market

-

Intimidating

Overwhelming

Performance-driven only

Jargon-filled

.png)

The Savvy Platform

-

Simple and clear

-

Jargon-free

-

Transparent approach

-

Performance and impact driven

.png)

.png)

.png)

There are so many funds out there and so much to research!

.png)

Are these funds in line with my values?

.png)

What type of funds should I invest in?

How Can We Make Choosing Investment Funds Easier for Everyday Investors?

Pain point #1- Difficult fund selection

Issues

Solution:

Sustainability questionnaire which matches users with investment funds that are in line with their values.

.png)

Simple, quick questions that get straight to the point.

Each card was linked to a specific Sustainable Development Goal, with questions adapting in real-time based on the user's preferences.

.png)

.png)

Progress bar to motivate users to finish.

Conveyor style belt animation to give momentum and energy to the questionnaire.

Solution:

User is recommended a

profile that is in line with their preferences and values. For example, the protector profile is aligned to energy efficiency, water scarcity, biodiversity conservation.

How Can We Provide Users with a Clear, Concise Snapshot of Their Investment Performance and Impact Without Overwhelming Them?

Pain point #4- Low Transparency

With an emphasis on clear language and simplicity, I created a dashboard allowing users to track both the financial and sustainable impact of their investments. Information hierarchy has been based off our research assumptions but to be validated through later user-testing.

Solution:

Personalised portfolio dashboard page-

All information shown to the user is based on how much the user has invested and their profile type (in this case-€10,000 and the protector profile).

How will this help the user?

Retail investors currently have to comb through 'fact sheets' (long winded documents), with Visibly they can see the most important information quickly and in a more visually stimulating form.

04-User Testing.

We conducted 11 user interview sessions with individuals who have invested before. We took the user through the prototype flow and asked general questions about the platform itself.

Affinity Diagramming

We had achieved what we set out to do as a team: we delivered a platform that enabled PostFinance to offer its clients a seamless, sustainable investment experience in the digital realm.

Conclusion

After multiple iterations and close collaboration with PostFinance's marketing, development, and innovation teams, we launched the platform with a pilot group. The journey was both rewarding and challenging, especially navigating the complexities of a banking environment. However, these challenges became opportunities for growth. By staying true to our vision and advocating for key design elements, we crafted a product that not only met the project's goals but also exceeded expectations.

User Quote about the Visibly platform:

'The platform feels really clean. Really like the visuals and how intuitive it is. As someone who doesn't have much experience in investing, I would definitely recommend this platform to others.'

The platform receiving high scores (majority 4's and 5's) for all areas of product design and usability questions (out of 118 respondents).

Check out work that I did for Daft.ie.- Ireland's largest property app.

Head of Product & UX Design for

Savvy is a B2B SaaS platform for wealth managers and private banks to streamline their digital offering of sustainable investment products while enhancing client engagement.

My role as

Creating a sustainable investment platform for PostFinance-Switzerland's largest retail Bank. From initial problem discovery through to platform delivery.

PostFinance identified an opportunity with 19% of their customer base (468,000 customers) to provide a simple and understandable sustainable investing experience.

I led the full design process from initial problem discovery (with the innovation team) through to design of the platform itself. Not only did the platform increase AUM (revenue), but improved the customer's perception of PostFinance.

My work on

How Can We Make It Clear and Simple to Understand What You're Investing In and Its Impact?

Pain point #2 and #3 -Greenwashing and little know-how

.png)

Clear layout of priority fund information in clear language.

Showing the user in everyday language what their money is doing (whether that be a positive or negative impact).

E.g. Based off your investment of €10,000 you have avoided 22,000kg of Co2 that is equivalent to 11 round trips flights from Dublin to New York.

Solution:

Funds shown to the user here are based off their specific answers to the questionnaire.

We have over 30 impact metrics, but selected the 9 most relevant to the user's key areas of interest.

.png)